9.1 Introduction

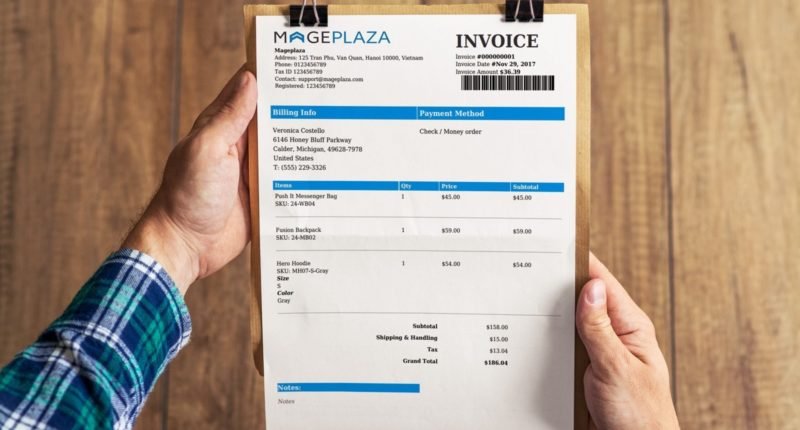

What is an Invoice?

An invoice is a bill or tab used as a commercial document issued from a seller to a buyer.

Invoices are legitimate documents that itemise a transaction between a buyer and seller. This can relate to sale transactions and typically indicates the quantity and product, as well as the agreed price for the product or service that the seller has provided for the buyer.

Payment terms will be stated on an invoice. Many times, invoices may be issued on credit (where the buyer is allowed to pay at a later date). The terms may include clauses whereby the buyer may be allowed a maximum time within which they are obliged to settle the invoice. Credit invoices may also include the payment options available to the buyer.

Invoices help keep track of sales of products and services and they are particularly useful for account and tax purposes.

Sometimes people may be offered a discount if they pay before the due date. A buyer can have already paid in full for products or services that have been listed on an invoice, so it may just be used like a receipt.

Invoices can include specific reference to the time duration and may also include details like quantity, price and any discounts offered. The more detail-specific an invoice, the easier it is to bill customers and keep records.

9.2 Difference between Invoice and Receipt

The underlying differences between an invoice and a receipt arise from when the document is issued during the purchase process.

The differences also arise from the different purposes of each type of document.

Invoices are generally issued by the seller once the product in question has been transferred to the buyer, but prior to receiving payment for it. A receipt, on the other hand, is issued by the seller once the payment has been made. Both documents (invoices and receipts) are issued by the seller, butwhile invoices are intended to request payment, receipts are records of payments made by the buyer.

9.3 Main Types of Invoices

Statement

A periodic customer statement could include bank balances, payments, credits, memos, debits and final balances. You may frequently come across these as you perform your job role as a PA. You will need to file them using your filing cabinet skills. Most invoice statements cover a specific credit period. Invoice statements may also include payment requests to the buyers.

Electronic invoice

Electronic invoicing is conventional invoicing stored and sent in an integrated electronic format from the seller to the buyer. Traditional paper invoicing is time-consuming and vulnerable to errors and slower than e-processing methods. The most important benefit of electronic processing involves the integration of the supplier's invoicing system with that of the buyer. This results in minimised likelihood of misunderstandings and miscommunication.

Electronic invoices can include PDFs, which are usually machine-readable. Data extraction techniques have allowed them to use what is known as EDI or XML invoicing. They usually contain official headers and are used by companies in different countries, but have internationally recognised symbols or logos.

Pro forma invoice

In foreign trade, there is a document that specifies commitment from a seller to provide goods to the buyer at specific rates. This will be used to declare value to customs, but is not an actual billing invoice so the seller would not store records. A Proforma invoice is intended to give the buyer an idea of how much the product would cost them. A Proforma invoice is not considered a binding document as the customer may or may not have agreed to the payment terms yet. It is sometimes referred to as a quote or estimate.

One of the biggest problems faced by buyers is the lack of information and detail about products. A well-prepared Proforma invoice can help overcome this lack of information. A Proforma invoice is always given in advance of the commercial invoice. The details on both are exactly the same except that there could be a difference in the pricing.

A Proforma invoice helps a buyer obtain letters of credit and helps them plan the transaction better.

9.4 Invoice Processing

Typical invoice processing involves paying a supplier.

The process begins at the arrival of the invoice - regardless of method of sending - this includes postal, email, facsimile, etc. When the invoice arrives, you would have to ensure that it is a valid invoice and classify it.

As the PA, you will probably be the person who sends out company invoices and pays other companies what they are owed. The invoice processing guidelines will be defined by the company you work for and external companies that you work with.

Once the category has been chosen, you would have to forward it to the person or company in question who needs to pay. You would always keep your own copy on file. If a purchase was made with regard to products or commercial goods, then the invoice must match the order to ensure the amount stated is correct. If the amount is correct and the goods have been received, the invoice may require a signature of confirmation to validate it.

Your manager, company and business will send and receive many different invoices. You must learn how to prepare them, receive them and file them for accounts, records, tax purposes, as well as for future reference.

9.5 Handling Petty Cash

To complete a cash reconciliation form, the petty cash custodian must list the remaining cash in hand, any vouchers issued or anything over/under the prescribed limit.

Voucher information may be provided from the petty cash book. If you are the petty cash custodian, you may always wish to keep copies of petty cash vouchers for cross-checking and reconciliation.

Obtaining cash

If you are one of the 'accounts payable staff', you can prepare a cheque that is made out to the cashier. The stated amount would be equal to whatever is needed to fund petty cash to all necessary stated limits. Accounts payable staff will forward petty cash reconciliation forms to a general ledger account.

Adding Cash to a Petty Cash Fund

As a PA or cashier, you are responsible for adding or recording what goes into the petty cash fund. Petty cash books should contain details pertaining to all amounts given and received. You should always update your running total of cash that is available at any given time.

Disbursing Petty Cash

Disbursing petty cash using the correct procedure is very important and may lead to confusion and stress if left undone. PAs who manage petty cash are entrusted with a great deal of responsibility.

A good disbursement procedure is essential to ensure that funds have been correctly documented between the concerned parties.

. Always screen disbursement requests even when the request pertains to funding minor business expenses.

. If a disbursement request is within the guidelines of your company rules, you can unlock the petty cash safe or storage unit. For security purposes, keep the safe locked at all times when not in use.

. While refunding money, you should typically record this with a slip or voucher. The record should indicate the amount that has been disbursed, the type of expense and name of the recipient of the refund. If there is a receipt, then store it along with the voucher for your account records.

. Disbursing cash: Count all cash that has been disbursed and make sure the recipient does the same for verification and cross-checking. Get the recipient to sign the voucher to prove that it is a valid refund. Store all completed vouchers in the petty cash box.

Activity 1 - Reviewing Invoicing Methods and Petty Cash

Estimated time: 10-15 minutes

This module covers the different types of invoicing, how to handle petty cash and invoice processing. These are all crucial to your job as a personal assistant because you will, at one point handle some of these methods of payments.

Since there are quite a few, and you might have to handle them all, take a few moments to review the advantages and disadvantages of them all and list a few of the benefits of these below.

Activity 2 - Working with Invoice Processing

Estimated time: 10-15 minutes

Now you have spent some time identifying the advantages and disadvantages of the different invoicing methods as well as petty cash. In this next activity, you will focus on the processing of invoices.

So, practise preparing invoices using pre-prepared invoices in your word processing program, or you can build one from scratch. Are there any invoice processing guidelines you should consider?

9.6 Disadvantages of Petty Cash

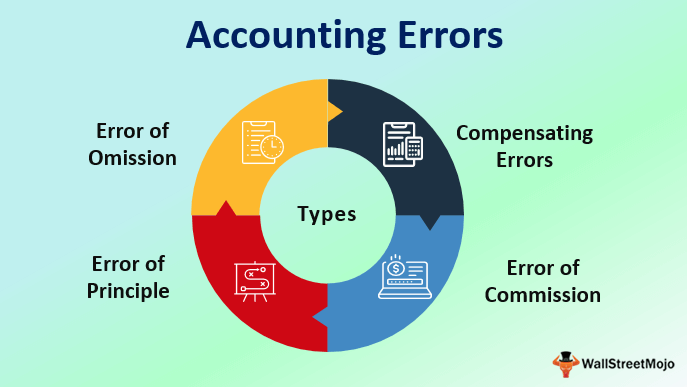

Accounting errors

Any petty cash system is more susceptible to accounting errors because they don't always involve secondary documentation when tracking cash. Errors can get worse when discrepancies between sales or receipts have to be reconciled with accounts at the end of each month. Petty cash discrepancies may happen from failure to accurately monitor the amount and usage of the petty cash funds. One can avoid this by using cash vouchers which we mentioned earlier in the module. There should be no verbal agreements with regard to disbursal of petty cash funds.

Theft

Although the topic may seem untoward, the fact is that any office is vulnerable to petty cash theft. Without proper safety or control, there is an increased risk of theft from the petty cash fund. The easier it is to access, the higher the risk factor involved. You could be the person held responsible for any losses (if you happen to be the person in charge of the petty cash fund).

It can be hard to trace the person responsible for the theft. Keeping large amounts of petty cash also increases the risk of theft. Avoid allowing anybody to access the petty cash. Access should be restricted to 2 people and the petty cash should be stored in a solid safe. Some people may also spend the cash without understanding the guidelines. This is referred to as misappropriation by employees who don't have the authority to determine how it is spent. The cash should not be spent on frivolous and leisure activities that will not help the business.

Over spending

Any failure to set an expenditure limit for transactions will quickly place the petty cash fund at risk of over-spending. You should keep the limit small to avoid any risks; for example, an amount like £100 is a good way to start.

Here are a few quick tips to manage petty cash efficiently:

1. Set clear guidelines on the nature and type of expenses that the office petty cash can be used

for.

2.Once a custodian is appointed (very often, the custodian could be the PA or secretary )should be entrusted with the responsibility. The senior management can also consider asking the custodian for suggestions on improving the petty cash management process. the custodian for suggestions on improving the petty cash management process.

3. If receipts are unavailable to document transactions, then the custodian can consider using pre-printed petty cash vouchers.

4. Petty cash expenses and disbursements should be recorded every month and the corresponding entries must be added into the accounting system.

5. Set a maximum limit for petty cash transactions. If the employee requires an amount that exceeds this, they would need the permission or sanction from the manager. Keep the rules consistent and transparent; this will help establish the process.

6. Keep a variety of note denominations and coins in the petty cash box. This will make it easier to disburse the amount close to what is required by the employee.

7. The custodian can consider creating a transaction log on a daily basis. Modern online transaction log systems help make it easier to reconcile accounts at the end of the month.

8. Each transaction will record two important details: Cash out (this refers to the amount of cash given) and expenses (this would refer to the details of the transaction and the nature of the requirement).

9. Monthly transactions should be reconciled and the petty cash storage location and access must be closely monitored.