5.1 Introduction

The vast majority of management roles within an organisation have

dealings with finance matters, to a greater or lesser extent.

Finance is an important part of operations management

The reasons for this are as follows:

* Generally, Operations Manager roles are senior management roles in a company and with this

level of seniority usually comes a responsibility for managing the budget and finances of a

department or area

* In the case of operations management, as it touches on a number of different activities and

processes across the business in the quest of getting the final product or service to market in

the most efficient and appropriate way possible, there is likely to be a high degree of exposure

in the role to the finances and budgets of all of the areas and departments involved in this

process. You may even be directly responsible for the achievement of budgets in particular

areas, particularly parts of the supply chain

* Often, Operations Managers report directly to the Area Director or Managing Director of the

company and therefore, a focus on the ongoing financial situation of the company is critical to

success and credibility in the role

We will spend some time in this module focusing on the important area of cost management, but to

begin with, let's take a closer look at some of the basic concepts of financial management and the

key documents and processes that you will need to be familiar with in your role.

5.2 Why do businesses need finance?

We already know that having a solid financial backing is critical for all

businesses.

The reasons for this are:

* To start up a new business. Finance is needed in order to buy or rent premises, take on new

staff, promote your product or service and begin trading

* To continue to run the business. Finance is needed to meet all of the ongoing commitments

that come with running a business, such as paying employee wages, paying suppliers, buying

materials, etc

* To potentially expand the business. You may need to invest in new product lines or services, or

open new premises in other locations or areas, in order to retain or expand your sales and

market share.

5.3 Sources of finance

There are lots of different ways in which to generate finance for a

business, usually split into internal and external sources. Some sources of finance areshort term and must be paid back within a year. Other sources of

finance arelong term and can be paid back over many years.

Internal Sources

Internal sources of finance are funds that come from within the business itself. One of the most common ways of doing this is to take a proportion of the profits made from selling

the goods or services and re-invest it back into the business. Another option is for the business to sellassets that it owns and no longer uses, in order to release

excess cash.

External Sources

External sources are funds from outside of the business, such as from creditors or banks.

Some examples of sources of external finance to cover the short term (usually less than

one year) include:

* An overdraft facility - an agreement with the bank or other lender to use money that is not in

its bank account, i.e. to draw a negative balance

* Trade credits - where suppliers are willing to deliver goods immediately, but wait a set amount

of time for payment

* Factoring - where firms sell their invoices to a factor such as a bank. This can be an effective

method of improving cash flow (discussed later in this module), as the business will be paid

immediately, instead of having to wait the standard 28 days

Some examples of sources of external finance to cover the longer term include:

directly into the business. In larger companies, the funding invested by shareholders is called

share capital

* Loans from a bank or other lending institution

* Mortgages for purchasing business property, such as premises

* Hire purchase or leasing, where monthly payments are made for the use of equipment or

facilities. Leased equipment is rented on a continuous basis, whereas hired equipment is

owned by the firm after the final payment is made

* Sometimes, national or local governments and councils, business groups, or charities offer

grants, in order to help businesses get started, or if they are providing a particularly needed or

niche market to customers

Activity 1

Estimated time: 15 minutes

Imagine that you have been appointed Operations Manager for a new start-up technology company. You have been asked to investigate methods of external financing, in order to purchase the

equipment that the business needs to begin trading.

Research the different methods mentioned and come up with at least two, fully justified, suggestions.

5.4 Creditors and debtors

Now that we understand a little more about the sources of a

company's finance, we need to understand some of the key individuals involved in financial

processes.

Two of the main ones are creditors and debtors.

A creditor is an individual or business that has lent funds to a business and is therefore owed

money.A debtor is an individual or business who has borrowed funds from a business and so owes it

money.

Creditors often ask for security before lending funds and usually charge interest on the funds that

are borrowed, although often, a company can offer assets as collateral in order to secure the debt.

The type of finance that a business chooses is a very personalised decision and varies from business

to business, depending on circumstances.

It is usually the case that start-ups and small firms are considered higher risk and can therefore find

it more difficult to raise external finance, as they have no track record or previous account for a

lender to assess. The only source of funds might be the owner's own savings or retained profits. Additionally, companies can issue extra shares to raise large amounts of capital in a rights issue.

Fact

The average personal debt of small business owners in

the UK is £30,000.

Source: Research by the Consumer Credit Counselling Service for The Independent.

5.5 Revenue, costs and profit

All businesses should keep proper accounts, detailing the

calculations of revenue, costs and profit.

Depending on the size of your business, you are likely to have either a finance team or dedicated

individual, usually an accountant, to handle these accounts, as they require specific skills and

expertise and must be accurate, consistent and transparent.However, it is important for Operations

Managers to understand some of the key concepts behind such accounts.

Revenue

The term revenue, sometimes also known as sales or turnover, relates to how much a company earns

across a set time period, usually through sales of its products or services. The two factors that are

involved in calculating revenue are the number of items sold and their selling price.

Therefore, revenue = price x quantity.

Costs

Costs are the expenses that a business incurs in running its affairs and making a product or offering

a service. For ease, costs are generally split down into fixed and variable costs. Fixed costs must be paid, regardless of how much the business produces.

Examples of fixed costs:

Rent, leases and employees' basic salaries.

Variable costs are different, as they change depending on how much the business produces.

Examples of variable costs:

Utilities, such as electricity and the cost of raw materials.

Costs can also be categorised by distinguishing betweendirect costs and indirect costs. Direct costs, such as raw materials, can be linked to the manufacture, production, or sale of a product, whereas

indirect costs, such as rent, cannot be linked directly to a product and are more general costs

relating to the business.

Profit and loss

After defining revenue and costs, we can now understand what profit is made up of. Essentially, profit is the surplus left from revenue after paying all costs and can be calculated by deducting total

costs from revenue.

For example

If a firm has a total revenue of £250,000 and total costs of £170,000, then they are left with £80,000

profit.

Of course, using the same calculation, if costs are more than revenue, a loss is made. Later in this

module, we will discuss some commonly used ways to reduce costs in order to turn a loss into a

profit.

5.6 Working with budgets

A budget is a structured document relating to the finances of an

organisation, usually covering a set period of time and makes up the financial plan of the

company during that period.

Some of the main components of a budget are anticipated sales volumes and revenues, expenses and

costs, assets, liabilities and cash flows.

Below are some of the main uses of a budget:

* A budget is essentially the financial plan of a business, detailing the financial targets and

objectives that the company wishes to fulfil

* It can be used as a means of measuring the performance of a business, financially and also

generally - Both external and internal stakeholders, particularly investors, have an interest in a

company's performance against its budget and use it to satisfy themselves that the business is

performing to expectations

* It can be used as a method for coping with adverse scenarios which are foreseen and to plan

out the financial response to particular situations .

5.7 What are the main parts of a budget?

Budgets can be as simple or complex as you make them, although it

is naturally common that larger organisations have more complicated budgets, using many

different variables.

However, most budgets maintain a relatively straightforward layout, as detailed below.

Revenue forecasting

This is one of the most vital elements of the budget process and it essentially refers to the prediction

of how much money the business is going to bring in, in the form of sales. Most businesses have a

core revenue stream, constituting sales from its main product and/or service lines, plus more ad-hoc

or one off revenues, such as asset sales. Financial analysts and accountants use a variety of methods, in order to predict future revenues. Historical sales data, trends in the market, external governmental or monetary policies, and changes

in competition and customer surveys are just a few methods that you can use.

Costs and expenses

We have already discussed business costs and how they are broken down into fixed/variable and

direct/indirect. You should include all costs in your budget process, no matter how seemingly inconsequential. Failure to properly account for costs in the planning stages can cause accounting problems further

down the line.

Servicing of debt

Don't forget to include the interest charges on the business's debts, such as business loans. If not

accounted for properly, it could adversely impact how much you have available to borrow at a later

date.

Cash flow projections

Cash flow can sometimes be overlooked from a financial perspective, but it is a critical factor in

ensuring that your business has the flexibility and fluidity to trade effectively. Of course, consideration of revenue and costs are important, but it is also key to make sure that the overall

cash flow situation of the business - that is, when the payments either arrive or come due for

payment - is healthy.

For example

You cannot assume that because you take a big stock order in November, you will receive the

revenue from it in that month. Equally, you may have to pay out for both production costs and

overhead costs before you receive that revenue. This is why strategic cash flow forecasting is imperative to any budget.

General projections

An important part of a budget is the creation of more medium and long term financial predictions

and scenario planning, instead of analysing just on a monthly or quarterly basis. This planning will

help you to see the growth or decline in your business, analyse like for like results and take quick

reparatory action quickly, where appropriate.

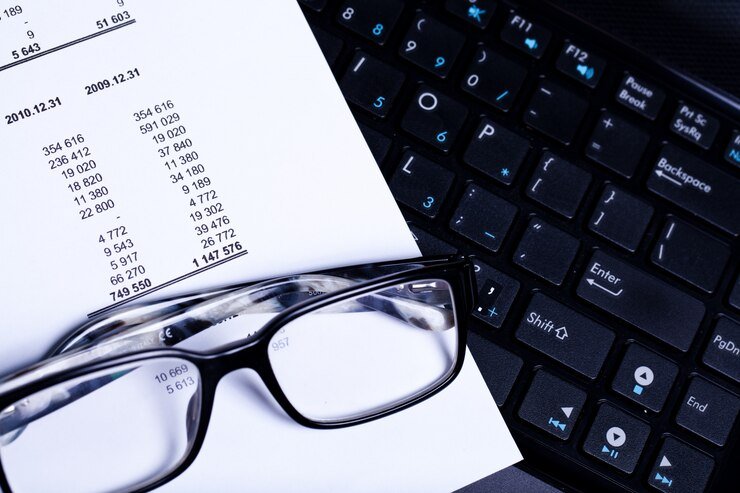

5.8 Using Balance Sheets

A balance sheet is a financial statement which breaks down the

assets, liabilities and capital of an organisation.

One of the key characteristics of a balance sheet is that it is drawn up to analyse the financial

position at a specific point in time. One of the main purposes of a balance sheet is to provide investors or potential investors

information about what a company owns, as well as the amount invested by shareholders. It can be

drawn up at any time, but is usually prepared at the end of the company's accounting period.

Usually, a balance sheet is formatted with two vertical columns, with one listing the assets of a

company and the other listing the financing of the company, further split into liabilities and

ownership equity.

An accurate balance sheet will show that the total of the assets on the left hand side will equal the

total of liabilities and owners' equity on the right hand side.

Asset Registers

An asset register is a record of all of the fixed assets of your business. Fixed assets are items that

the business owns, such as equipment, systems, etc and uses on a regular basis in order to produce

the products or services that generate its income. Fixed assets differ from other assets such as

stock/inventory, as they are permeant features of the organisation, not temporary items with the

purpose of being sold.

A good way of distinguishing a fixed asset is that you can expect to own it for more than one year.

Here are some examples of the fixed assets of a business:

* Buildings

* Fittings and fixtures

* Vehicles

* Land

Furniture

* Office equipment

* Manufacturing equipment

* Technological equipment

Depreciation

Depreciation is when the monetary value of an asset declines during its lifespan.

For example

A piece of machinery that you purchased for £20,000 will not be worth the same amount three, five

or 10 years later.

In order to budget effectively and to understand the true cost of a piece of equipment, you need to

understand how its value will depreciate over time. Depreciation needs to be built into your balance

sheet, to ensure that you are allocating a more accurate monetary figure towards your assets.

Below are some common methods of working out depreciation.

Straight line method

This is the most commonly used method and is possibly the simplest to use, as well.

To calculate depreciation using this method, just divide the difference between the start and end

cost of your equipment by the number of years of its anticipated useful life. The cost is reduced in a

uniform fashion across its lifespan of the equipment and therefore, appears as the same figure on

the balance sheet every year.

The formula is:

Depreciation = depreciable amount (cost minus salvage value) / useful life

Whilst this is a simple and useful formula to use to calculate depreciation, critics of the method point

out the fact that often, an asset loses more of its value in the early years of its life than in the later

years and therefore, this uniform reduction is not necessarily strictly accurate.

Reducing balance method

This method of depreciation aims to overcome the possible issue with the straight line method as

discussed above, by reducing the cost at a higher rate in the earlier stages of the equipment's

lifespan.

Many say that this is a much more realistic method of working out the depreciation of an asset, but

the drawback is the fact that you have to assign different values to the asset for each year of its

lifespan on the balance sheet and this can be harder to calculate and more complicated to use.

Unit of production method

This method of depreciation also aims to come to a more accurate depreciation figure, by calculating

depreciation taking account of how much the equipment is actually used during its life. The concept

behind this method is that assets or equipment that are used heavily will depreciate more quickly, due to wear and tear.

A note on the lifespan of equipment

In our definitions of depreciation in the section above, we have referred to the lifespan of the asset.We also need to know what the lifespan of equipment is, so that we can decide when we need to

replace it and how long it will be effective for.

There are a couple of common ways in which to determine the life of a piece of equipment.

Firstly, you can use its physical life - the end of which is when it can no longer perform the functions

that it is required to, reliably and consistently.

Secondly, you can use its profit life - this is essentially the period of time for which the equipment

can earn a profit for the business, i.e. it is useful.

5.9 Cost management and ways to cut costs

In your role as an Operations Manager, you are likely to find

yourself involved in cost management activities, either on a regular basis, as a business as

usual activity, or as a one off project, if the business has identified that structured and

timely cost saving measures need to be taken.

Depending on the scope of the cost management exercise, you may be looking at costs in a

particular area of the business, or undertaking an all-encompassing review of all activities across the

company.

There is no magic formula to deciding which areas to focus your cost cutting exercise on and much

will depend on your particular set of circumstances, as one measure may work for one business and

not for another.

Similarly, one measure may have a much smaller impact on the bottom line in one industry or

business than in another and may therefore mean that it is not worth doing, or it may have too big

an impact in either areas to cut it. However, below are some of the more commonly used cost cutting

methods.

Reduce wastage

Firstly, keeping excess stock that you may not use can increase your storage costs.

Secondly, a common way to save money on purchasing is to buy in bulk and, whilst this can achieve

good cost savings in some cases through economies of scale, care should be taken not to over- purchase or tie yourself into high volume agreements with suppliers on the premise of achieving

economies of scale, as it can lead to wastage.

This is a particular problem if the product is perishable or is regularly updated, leaving it unfit for

purpose or out of date.

Re-negotiate your fixed costs

Upon further inspection, you may find that the business is tied into historic agreements with

suppliers which are no longer cost effective or no longer meet the current needs of the business

effectively.

For example

You may have an agreement with a maintenance company to pay them a set monthly fee for support, but you may not justify the spend on the amount that you call them out. This agreement probably

does not offer you good value for money and simply doing some research, comparing other suppliers

and negotiating can often pay dividends in cost saving terms.

Headcount freeze

Implement a headcount freeze or a reduction in head count. A headcount freeze occurs when a

company chooses not to recruit any further staff for a set period of time, in an attempt to reduce

costs. Usually, replacements for leavers in business-critical roles are permitted, but managers must

go through an authorization process prior to embarking on recruitment for their team.

Alternatively, a headcount reduction is a more drastic step and involves actively reducing the

number of employees in an organisation - this can happen through natural wastage (not replacing

leavers), but a quicker method is to undertake a voluntary or compulsory redundancy programme.

Prior to embarking on the redundancy route, you should perform a detailed business case exercise, to ensure that the initial outlay in costs of redundancy payments and the potential residual effect of

skills shortages within the business will not have a more negative effect on your business than not

carrying out the redundancy exercise.

Fact

In the three months to February 2017, 106,000 people

had been made redundant.

Source: Of ice for National Statistics

Cut down spending on overtime

You could consider introducing a cap on paid overtime, or even temporarily halting it altogether for

a set period of time, to reduce variable staff costs. However, a careful analysis of the business needs

should be carried out before taking this option, as you need to ensure that it doesn't result in an

adverse impact on the ability of the business to meet customer demand effectively.

Reduce non-essential or discretionary spending

Consolidating spending can be a great tactic in this area.

For example

This may involve reducing the number of training days per employee that your company offers, or

even combining training events with other departments or with a team meeting. Consider where you can make energy savings

Sometimes, simple changes such as setting heating and lighting to a lower consumption setting or

ensuring that all appliances and equipment are switched off overnight can help considerably over

the course of a year. Motion-detecting devices that turn off some appliances at night and

thermostats to efficiently control the temperature of a building are newer interventions which, although involving an initial outlay, can provide you with cost savings year after year. In addition, reviewing your utility contracts is another effective way of making sure that you are paying the right

price.

Activity 2

Estimated time: 15 minutes

Consider the fact that the Managing Director of the company that you work for, or one with which

you are familiar, has tasked you with reducing costs by 15% across the next 18 months, with as little

impact on revenue, quality, or customer care, as possible. Review the list of suggested cost cutting measures, along with your own ideas and detail the most

appropriate methods that you suggest, giving reasons.